The question of how to achieve financial freedom worries many – especially in times of severe crisis.

Unfortunately (or fortunately), it is simply impossible to achieve this state at once - it requires careful work on yourself and your finances, establishing control over cash flows and a complete reworking of consciousness. Becoming financially independent may take a long time - but being free is definitely worth it. From this article you will learn:

- What is financial independence?

- Types of financial status

- Key steps towards financial independence

How to achieve financial independence

Almost all people dream of achieving a level of well-being at which they don’t have to fight for every penny, that is, to gain financial stability.

But how difficult is it to become independent from money? As Natalya Pritchina, LIME correspondent, says, many have still not been able to solve this problem. But if you follow simple strategies, it turns out that understanding how to achieve financial independence is very easy. Experts are sure that every person needs to understand this.

Creation of reserve capital

Reserve capital is a mandatory reserve that will come in handy in case of unforeseen circumstances (loss of a job, business, solving major household issues, treatment, etc.) that require large financial expenses.

Experts advise doing it in the amount of 3-6 monthly amounts of your expenses.

Let's look at some rules for creating reserve capital:

- Regularity of investments. Set aside a percentage of your salary or other income each month. It is better to do this right away, without waiting until the end of the month. Otherwise, the money you earn may be wasted.

- Inviolability of capital until unforeseen circumstances occur. This may seem the most difficult. Learn to restrain yourself from momentary spending for the sake of larger benefits in the long term.

- Quick access to money. The money in your emergency fund should be available to you at any time in case you need it to invest in your passive income. To store money in a bank, it is best to open a replenishable deposit with the possibility of early withdrawal of the deposit without loss of interest.

- Fund replenishment. If force majeure did occur and you had to take part of the money or the entire amount from the reserve fund, try to return to replenishing it as soon as the situation stabilizes.

Once your emergency fund is created, you can move on to the next step in your financial journey.

Strategy 3. Cash flow control

After drawing up a plan, it is necessary to take into account all existing income and expenses. Katerina Zhizhina also thinks so, saying that it is boring and boring, but without this there cannot be a significant increase in well-being. Any earnings can be spent quickly and ineptly: 15 thousand rubles, and 15 million rubles. It's not about the amount of income as such, but about the attitude towards money. Rockefeller always scrupulously and carefully analyzed all expenses, even when he became a multimillionaire.

Be sure to count your money and budget carefully. Only by knowing the current state of affairs and planning your expenses ahead can you move towards financial independence. Moreover, managing a budget has now become much easier, according to Leysan Khalikova, an expert at VIGTrans, reporting that many applications have appeared on the phone that help keep track of expenses and income, as well as set aside a certain amount for your goals. This is a very convenient tool that really works and helps develop self-discipline.

Natalia Pritchina, LIME: “Developing a budget is a necessary element in order to stick to your main goals. Try it yourself: a well-drafted financial plan will become your main assistant in setting priorities. Thanks to it, you can avoid unnecessary impulsive spending. Don’t forget the most important thing: when money is spent haphazardly, there is always a chance that you will be left broke a few days before payday.”

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Tatyana Kurchanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Rishat

09.20.2020 at 09:54 Good afternoon Tatyana, the article is useful and interesting, many financial books describe a similar scheme of action, tell me what stage you are at, what instruments do you invest in?

Reply ↓

Reduce your expenses

The less money you spend, the easier it is for you to increase your own savings rate and get to that very 40-50% of your income.

You can cut costs:

- for housing (by searching for cheaper rent, refinancing a mortgage, receiving tax deductions);

- for things you don’t use (subscriptions to TV channel packages, home phone and expensive mobile tariff, gym where you don’t go);

- for insurance (there are companies where you can buy a policy cheaper than from well-known brands);

- for a car (do not buy too expensive models, choose brands that save fuel).

Use cards with maximum cashback for purchases, and when ordering online, also use cashback services. This will allow you to return a few percent from each spend.

It is important not to get into debt on credit cards - always stay within the grace period, during which the bank does not charge interest.

Read on topic: 10 cashback services that will help you save

Invest strategically

Financial independence in 5 years is not possible unless you invest strategically. Focus on finding the best investments to generate passive income streams in the long term. Chances are you'll decide to max out a few investment accounts each year.

Real estate investing and index funds are the best ways to create wealth. Do your research and develop a strategy that suits your time. If you need help, consult a financial advisor.

Stocks, real estate, collectibles, or cash investments all tend to rise and fall in value. Focus on investments purchased at attractive prices that are likely to appreciate in value over time.

Where to find money for capital formation

This question is asked by everyone who lives from paycheck to paycheck and does not have extra money even for small quality pleasures. But finding money is possible at any income level. You can increase its level in several ways:

- find a better paying job;

- start investing;

- Start your own bissnes.

To find a job with a higher salary, you need to increase your “worth” to employers with relevant skills and abilities. Study job advertisements and requirements for candidates for vacancies with a good salary. Any of these skills can be learned.

Spend time and money on self-development. Learn the science of investing. Attend specialized seminars, training sessions, study literature, and use the help of a financial advisor.

When your investment portfolio reaches a significant size and you can earn interest above your monthly active income, then financial freedom will come.

So, a husband and wife receive $1,000 monthly between them.

From the day they decide to achieve financial independence, they begin to save a quarter of their salary in order to invest it with a yield of 30% per year. According to young people, the remaining $750 is enough for them to live a normal (in their understanding) life.

$250 will be saved per month, per year – 12 x $250 = $3000. Now we need to take into account compound interest. Each amount begins to work for a young family from the moment it is invested. That is, the first payment gives a profit of 12 months, the second – 11, the third – 10, etc. If you do the math, you get the same figure as if you put the entire amount at half interest: $3,000 x 15% = $450. In total, by the end of the first year, the family will have the amount (contributions + compound interest): $3000 + $450 = $3450.

Why is this especially important for women?

Because here the issue is more acute than among men. It is simply more difficult for a woman to achieve financial independence, and here's why.

- Employers are more willing to hire men Employers have become less likely to pay attention to the marital status of applicants, but gender preferences remain. To compete in such a situation, women are forced to accept less. When competing with men for jobs, women accept wages that are lower than market wages. On average, they receive 30% Russian women are paid 30% less than men in the same positions with the same responsibilities. The reasons for this are not only gender stereotypes, but also gender-related circumstances, which are discussed below. They also make women financially vulnerable on their own.

- Only 2% decide to take maternity leave. Every fiftieth father in Russia takes paternity leave; women more often go on maternity leave. As a result, it is she who loses 60% of her earnings for a year and a half, and then, until the child is three years old, she is left with no income at all. In addition, during maternity leave you can seriously “sag” in your career, since in the 21st century this is a huge period for the development of many industries.

- Traditionally, it is believed that the husband is the breadwinner, and the wife is the keeper of the hearth. Contrary to expectations, this does not mean that the latter are sitting on the necks of the former. In Russia, 74.4% of the Labor force, employment and unemployment in Russia are women of working age and 80.3% of men - the difference is small. But women are often expected to easily sacrifice their careers for the sake of their husband’s employment if he is offered a move, and not to stay late at work in order to cope with household chores. They are the ones who stay home if a child is sick. All this is reflected in the salary.

- And again traditions: it is considered unacceptable if the woman in a couple earns more than the man. Often it is precisely such attitudes that significantly limit career growth. And at various trainings, women are even persuaded to quit right now, because working is not their true purpose and in general it’s bad.

What is it really like?

To switch to passive income, you will need to competently create an investment portfolio.

Use the principle of diversification - investing capital in different investment projects. You can diversify assets by type (securities, real estate, business, precious metals), by currencies, terms, risks, by industries, regions, by profitability.

The more diverse the asset investments, the lower the risk of losing all your money at once. If one of the projects is unprofitable, you will be able to compensate for the losses at the expense of the other.

Tips for investing development:

- explore possible ways to invest money in your country;

- invest part of your income (20-40%);

- create an investment portfolio;

- take into account the rules of investment diversification;

- control investments, maintain regular records and analysis;

- build your investment portfolio taking into account long-term trends.

And the most important thing: gradually move from active to passive employment, focusing exclusively on your projects. As soon as passive income exceeds expenses, financial independence will come.

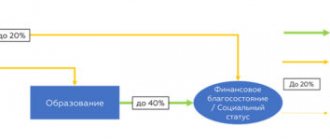

Types of economic status

- Money pit. In this option, income does not cover expenses at all, so you have to constantly borrow money to pay off the previous ones. Accordingly, there can be no talk of savings. This condition is very difficult, but it is quite possible to get out of it.

- Instability . The income-expense ratio is approximately equal. If debts occur, they are for a short period of time. Due to the fact that there are no savings, any unforeseen situation (job loss, illness...) can drag you into a money pit.

- Stability . In this case, you manage to receive more than you spend. And even if a crisis situation occurs, a person in this state may well survive for several months.

- Economic freedom. In addition to the fact that income significantly exceeds expenses, existing liabilities do not require inclusion. There are also significant savings that can easily last you for a very long period of time.